Cryptocurrency adoption has surged globally, transforming from a niche interest to a mainstream financial trend. As digital currencies gain traction, understanding the factors driving this growth and the market’s evolution becomes essential. This article delves into the global adoption rates of cryptocurrencies, highlighting the key drivers behind market expansion, from technological innovations to regulatory shifts. We will analyze the performance of major cryptocurrencies and explore the challenges and risks associated with their adoption. Finally, we look ahead to predict future market trends, offering insights into the potential directions of the cryptocurrency landscape in the coming years.

Join tirfblog.com as we delve deeply into this topic.

1. Overview of Cryptocurrency Adoption Rates Globally

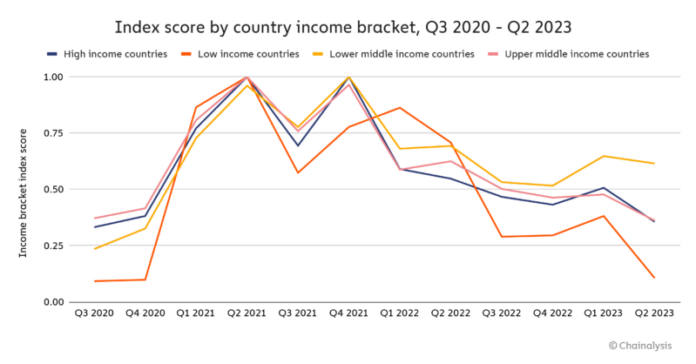

The global adoption of cryptocurrencies has witnessed exponential growth over the past decade, driven by increasing awareness, technological advancements, and economic factors. Initially concentrated in tech-savvy communities, digital currencies have now penetrated various sectors and regions, with countries like the United States, South Korea, and Japan leading the charge. Developing nations, particularly in Africa and Latin America, are also seeing a rapid increase in adoption due to the need for alternative financial systems amidst economic instability.

Cryptocurrency adoption is no longer limited to individual investors; institutional interest has surged, with major corporations and financial institutions integrating cryptocurrencies into their operations. This widespread acceptance is further fueled by the rise of decentralized finance (DeFi) platforms, enabling users to engage in lending, borrowing, and trading without traditional banking intermediaries.

However, the pace of adoption varies significantly across regions, influenced by factors such as regulatory environments, infrastructure development, and public perception. While some countries have embraced cryptocurrencies, others remain cautious, leading to a fragmented global landscape. Despite these disparities, the overall trend indicates a steady rise in global cryptocurrency adoption.

2. Key Drivers of Cryptocurrency Market Growth

The cryptocurrency market’s rapid growth is driven by several key factors, elevating digital currencies from a speculative asset to a viable financial instrument. A primary driver is technological innovation, particularly the development of blockchain technology, which ensures transparency, security, and decentralization in transactions. This has attracted both individual investors and institutions seeking alternatives to traditional financial systems.

The growing distrust in conventional banking, particularly in areas facing economic instability or rampant inflation, is another crucial factor. Cryptocurrencies, with their decentralized nature and resistance to inflation, present an appealing alternative for individuals seeking to safeguard their assets against economic volatility.

Market growth has been significantly influenced by regulatory developments. Clearer regulatory frameworks in numerous countries have legitimized cryptocurrencies, fostering wider adoption among both businesses and consumers. Moreover, the emergence of decentralized finance (DeFi) and non-fungible tokens (NFTs) has expanded the applications of cryptocurrencies, attracting new users and investments.

Finally, the worldwide shift toward digital technologies, spurred by the COVID-19 pandemic, has led to heightened interest in digital currencies, further driving the market’s growth.

3. Impact of Regulatory Changes on Cryptocurrency Adoption

Regulatory changes have had a profound impact on cryptocurrency adoption, shaping the way digital currencies are perceived and utilized globally. In regions where clear and supportive regulations have been established, cryptocurrency adoption has accelerated, attracting both individual investors and institutional players. For instance, countries that have implemented comprehensive legal frameworks have seen increased confidence among users and businesses, leading to greater integration of cryptocurrencies into mainstream financial systems.

Conversely, in areas where regulations are ambiguous or overly restrictive, adoption rates have been slower. Uncertainty around legal status and potential government crackdowns have deterred some from participating in the cryptocurrency market. Moreover, stringent regulations in certain countries have led to the relocation of crypto businesses to more favorable jurisdictions, influencing the global distribution of cryptocurrency activities.

Overall, regulatory clarity plays a crucial role in fostering trust and stability in the cryptocurrency market. As governments continue to refine their approaches, the balance between innovation and regulation will be key to the future growth of cryptocurrency adoption.

4. Technological Innovations Influencing Cryptocurrency Trends

Technological innovations have been at the forefront of shaping and driving cryptocurrency trends, making digital currencies more accessible, secure, and functional. The evolution of blockchain technology, a key advancement, has been instrumental in this transformation. As the foundation of cryptocurrencies, blockchain has enabled the development of decentralized and transparent financial systems, reducing reliance on intermediaries and enhancing transaction security.

The advent of smart contracts, especially through platforms like Ethereum, has significantly broadened the applications of cryptocurrencies. By automating and enforcing agreements without intermediaries, smart contracts empower the creation of decentralized applications (dApps) operating on blockchain networks. These advancements have fueled the emergence of decentralized finance (DeFi), enabling users to participate in activities such as lending, borrowing, and trading, all without relying on traditional banking institutions.

Furthermore, the advent of layer 2 solutions, like Bitcoin’s Lightning Network, has tackled scalability problems by facilitating faster and more affordable transactions. This development has been instrumental in making cryptocurrencies more practical for everyday applications.

The integration of artificial intelligence and machine learning into blockchain analytics has played a significant role in refining market strategies and enhancing security measures. These technological advancements continue to expand the potential of cryptocurrencies, making them increasingly important to the global financial landscape and driving their adoption across diverse sectors.

5. Analysis of Major Cryptocurrencies and Their Market Performance

The performance of major cryptocurrencies has varied significantly, reflecting the dynamic nature of the market and the factors influencing each digital asset. Bitcoin, as the pioneering cryptocurrency, remains the most dominant, often viewed as digital gold due to its store of value. Its price movements frequently set the tone for the broader market, and its adoption by institutional investors has bolstered its status as a mainstream asset.

Ethereum, the second-largest cryptocurrency by market capitalization, has distinguished itself through its robust blockchain platform that supports smart contracts and decentralized applications (dApps). This versatility has made Ethereum a key player in the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Other major cryptocurrencies, such as Binance Coin (BNB), Cardano (ADA), and Solana (SOL), have gained prominence due to their unique technological features and growing ecosystems. However, market performance remains volatile, with prices influenced by factors such as technological upgrades, regulatory developments, and broader economic conditions. Despite these fluctuations, these major cryptocurrencies continue to shape the future of the digital asset landscape.

6. Challenges and Risks in Cryptocurrency Adoption

Despite the growing adoption of cryptocurrencies, several challenges and risks remain, posing obstacles to broader acceptance and integration into the global financial system. One of the primary challenges is regulatory uncertainty. While some regions have established clear guidelines, others have yet to define their stance on cryptocurrencies, creating an environment of ambiguity that can deter potential users and investors. The fear of sudden regulatory changes or crackdowns further adds to this uncertainty.

Security concerns also present significant risks. While blockchain technology is inherently secure, the ecosystem surrounding cryptocurrencies, such as exchanges and wallets, is vulnerable to hacking and fraud. High-profile security breaches have resulted in substantial financial losses, undermining confidence in the market.

Volatility is another critical issue. The price of cryptocurrencies can fluctuate wildly, making them less reliable as a store of value or medium of exchange. This volatility can be a barrier to adoption, particularly for risk-averse individuals and institutions.

Moreover, the environmental impact of cryptocurrency mining, particularly for proof-of-work currencies like Bitcoin, has drawn criticism. The energy-intensive nature of mining operations has led to concerns about sustainability, prompting calls for more eco-friendly alternatives.

Finally, the complexity of understanding and using cryptocurrencies remains a hurdle for many potential users. Without widespread education and user-friendly interfaces, the adoption of cryptocurrencies may be limited to more tech-savvy individuals, slowing their overall growth.

7. Future Predictions for Cryptocurrency Market Trends

Looking ahead, the cryptocurrency market is poised for significant evolution, driven by several key trends. One prominent trend is the burgeoning growth of decentralized finance (DeFi). As DeFi technology matures and user adoption expands, DeFi platforms are anticipated to become increasingly integral to the financial landscape, offering innovative solutions for lending, borrowing, and trading.

Blockchain technology continues to evolve, with notable advancements in areas such as layer 2 solutions and consensus mechanisms. These developments aim to overcome scalability challenges and lower transaction fees, paving the way for cryptocurrencies to become more practical for everyday use.

As regulatory frameworks solidify and become more supportive, institutional adoption is expected to grow. Greater participation from institutional investors will likely foster market stability and legitimacy, further attracting mainstream users.

Environmental sustainability will take center stage, as the industry faces mounting pressure to embrace greener technologies and practices. The move towards proof-of-stake and other energy-efficient consensus algorithms could alleviate concerns about the environmental footprint of cryptocurrency mining.

Lastly, the evolving regulatory landscape will continue to shape market dynamics. As governments and regulatory bodies implement clearer rules, the cryptocurrency market is anticipated to become more organized, leading to increased confidence and wider acceptance.

As the cryptocurrency landscape evolves, driven by technological innovations and shifting regulations, the future holds promise for broader adoption and integration into the global financial system. While challenges remain, ongoing advancements and increasing institutional interest suggest a dynamic and potentially transformative future for digital currencies.

tirfblog.com