In today’s dynamic financial landscape, effective risk management is crucial for safeguarding business stability and growth. Our article, “Top Financial Risk Management Strategies: Expert Insights and Latest Trends,” delves into essential strategies for navigating financial uncertainties. We explore common financial risks, emphasizing the significance of thorough risk assessment and analysis. The discussion includes practical techniques for mitigating risks, such as diversification, financial derivatives, and insurance. Additionally, we highlight how technology and analytics are revolutionizing risk prediction. Concl

Join tirfblog.com as we uncover the details of this topic.

1. Identifying Common Financial Risks in Business

In the complex world of business, identifying common financial risks is the first step toward effective risk management. Financial risks can arise from various sources, including market fluctuations, credit issues, liquidity constraints, and operational challenges. Market risks, such as changes in interest rates, foreign exchange rates, and commodity prices, can significantly impact a company’s profitability and financial stability. Credit risks involve the possibility of a borrower defaulting on their obligations, affecting the company’s cash flow and financial health. Liquidity risks, on the other hand, pertain to the inability to meet short-term financial obligations due to insufficient cash flow. Additionally, operational risks, including disruptions in supply chains or technological failures, can also pose significant threats. Identifying these risks involves a thorough examination of both internal and external factors that could potentially impact the business. By understanding and categorizing these risks, companies can develop tailored strategies to mitigate their effects and enhance overall financial resilience. This proactive approach not only safeguards against potential losses but also positions the business to navigate uncertainties with greater confidence and agility.

2. Importance of Risk Assessment and Analysis

Risk assessment and analysis are fundamental components of a robust financial risk management strategy. By systematically evaluating potential risks, businesses can gain a clear understanding of their vulnerabilities and the potential impact on their operations. This process involves identifying, quantifying, and prioritizing risks based on their likelihood and potential consequences. Effective risk assessment helps organizations allocate resources more efficiently, focusing on the most significant risks that could affect their financial stability. It also aids in developing appropriate risk mitigation strategies tailored to specific threats. Analyzing risks allows businesses to anticipate and prepare for potential challenges, reducing the likelihood of unforeseen financial setbacks. Moreover, regular risk assessment and analysis enable companies to stay ahead of emerging risks and adapt to changing market conditions. This proactive approach not only enhances decision-making but also improves overall resilience and adaptability. In essence, a comprehensive risk assessment and analysis process is crucial for minimizing financial uncertainti

3. Implementing Risk Mitigation Techniques

:max_bytes(150000):strip_icc()/Enterprise-risk-management_final-3fb67ffdaafb4d3b879de7a0940f6fe7.png)

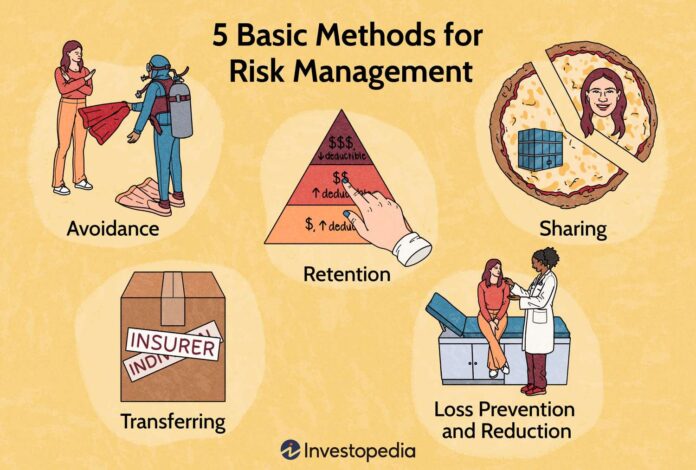

Implementing risk mitigation techniques is essential for managing and minimizing financial risks effectively. Once risks have been identified and assessed, the next step is to apply strategies designed to reduce their potential impact. One common technique is risk avoidance, which involves altering plans or operations to eliminate or avoid exposure to certain risks. For instance, a company might diversify its product line or market presence to reduce dependency on a single revenue stream.

Risk reduction focuses on minimizing the impact or likelihood of risks through specific actions. This could include improving internal controls, enhancing financial reporting practices, or implementing rigorous compliance measures. Another approach is risk transfer, which involves shifting the risk to another party, such as through insurance policies or outsourcing certain functions. By transferring risk, companies can protect themselves from potential financial losses while leveraging the expertise of external providers.

Finally, risk acceptance is a strategy where businesses acknowledge certain risks and prepare to manage them without specific mitigation efforts. This approach is often used for low-impact risks where the cost of mitigation outweighs the potential losses. By employing these techniques, businesses can create a comprehensive risk management framework that enhances their ability to handle financial uncertainties and safeguard their assets.

4. Diversification as a Risk Management Strategy

Diversification is a key strategy in financial risk management that involves spreading investments across various assets or business activities to minimize exposure to any single risk. By diversifying, companies reduce the impact of adverse events affecting one particular area of their business. For example, investing in a mix of asset classes, such as stocks, bonds, and real estate, can mitigate the risk of significant losses from market fluctuations in any single asset class.

In addition to financial assets, diversification can be applied to business operations. Companies might expand into new markets, develop new products, or acquire businesses in different industries to spread their risk. This approach helps in buffering against economic downturns or sector-specific challenges. Diversification not only reduces the risk of substantial financial losses but also enhances the potential for overall growth and stability. By employing a well-structured diversification strategy, businesses can better w

5. Utilizing Financial Derivatives for Risk Hedging

Utilizing financial derivatives for risk hedging is a sophisticated approach to managing financial uncertainties. Derivatives, such as options, futures, and swaps, are financial contracts whose value is derived from underlying assets like stocks, commodities, or interest rates. These instruments allow businesses to lock in prices or rates, providing protection against adverse movements in the market.

For example, futures contracts enable companies to set prices for commodities they will buy or sell in the future, mitigating the risk of price fluctuations. Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price, offering a way to manage potential losses while retaining the opportunity for gains. Swaps can be used to exchange cash flows or other financial instruments, helping manage interest rate or currency risks.

By incorporating derivatives into their risk management strategies, businesses can effectively hedge against market volatility, ensuring more predictable financial outcomes and protecting their profit margins from unforeseen changes in market conditions.

6. Role of Insurance in Financial Risk Management

Insurance plays a crucial role in financial risk management by providing a safety net against unforeseen losses and liabilities. It acts as a risk transfer mechanism, allowing businesses to shift the financial burden of potential risks to an insurance provider. This can be particularly valuable for mitigating risks related to property damage, legal liabilities, and operational disruptions.

For instance, property insurance safeguards against losses due to damage from events like fires or natural disasters. Liability insurance covers legal costs and settlements arising from claims of negligence or harm caused by the business. Business interruption insurance compensates for lost income and ongoing expenses when operations are halted due to covered incidents.

Moreover, specialized insurance products, such as cyber insurance, offer protection against risks associated with data breaches and cyberattacks. By investing in appropriate insurance policies, businesses can manage financial risks more effectively, ensuring that they are better equipped to recover from setbacks without significant financial strain.

Incorporating insurance into a comprehensive risk management strategy allows businesses to protect their assets, maintain financial stability, and focus on their core operations with greater confidence. It serves as a critical component in mitigating financial risks and ensuring long-term resilience.

7. Leveraging Technology and Analytics for Risk Prediction

Leveraging technology and analytics for risk prediction has become a pivotal aspect of modern financial risk management. Advanced technologies, such as big data analytics, artificial intelligence (AI), and machine learning, enable businesses to anticipate potential risks with greater accuracy and efficiency. These tools analyze vast amounts of data to identify patterns, trends, and anomalies that could signal emerging risks.

Big data analytics allow for the integration and examination of diverse data sources, providing a comprehensive view of potential risk factors. For instance, analyzing market trends, customer behavior, and economic indicators can help businesses predict fluctuations in demand or financial instability. AI and machine learning algorithms further enhance predictive capabilities by learning from historical data and adapting to new information, offering real-time insights into risk exposure.

Predictive analytics also play a crucial role in scenario modeling, where businesses can simulate various risk scenarios and assess their potential impact. This helps in preparing contingency plans and making informed decisions to mitigate risks effectively.

By integrating these technological advancements into their risk management strategies, businesses can proactively address potential threats, improve decision-making, and enhance their overall financial resilience. Technology-driven risk prediction tools provide a significant edge in navigating the complexities of today’s financial environment.

8. Expert Opinions and Future Trends in Risk Management Strategies

Expert opinions and future trends in risk management strategies highlight the evolving landscape of financial risk management. Industry experts emphasize the growing importance of integrating advanced technologies, such as artificial intelligence and blockchain, to enhance risk assessment and mitigation. AI and machine learning are expected to drive more accurate predictive analytics, offering real-time insights and enabling businesses to anticipate and respond to risks more swiftly.

Furthermore, blockchain technology is gaining traction for its potential to improve transparency and security in financial transactions, reducing the risk of fraud and operational disruptions. Experts also point to the increasing emphasis on environmental, social, and governance (ESG) factors in risk management. Businesses are now incorporating ESG considerations into their risk strategies to address sustainability and social responsibility concerns, which are becoming critical to stakeholders and investors.

The future of risk management is likely to see a greater focus on integrating risk management with overall business strategy, fostering a more proactive and agile approach. Continuous innovation and adaptation to emerging risks will be key, as businesses strive to stay ahead of a rapidly changing risk environment. Embracing these trends will be essential for maintaining resilience and achieving long-term success in the face of evolving financial challenges.

In conclusion, mastering financial risk management requires a multifaceted approach, incorporating strategies such as diversification, insurance, and financial derivatives. By leveraging technology and analytics, businesses can enhance their predictive capabilities and better prepare for uncertainties. As industry trends evolve, integrating advanced tools and ESG considerations will be vital for staying ahead of emerging risks. Adopting these strategies will not only safeguard financial stability but also position businesses for long-term success in an increasingly complex financial landscape. Effective risk management is essential for navigating today’s challenges and achieving sustainable growth.

tirfblog.com

tirfblog.com